Help for existing car insurance customers

Your Insurance Account

Your Insurance Account is the quick and convenient way to manage your car insurance policy online. Register now for access to your policy wherever and whenever suits you best.

Make a claim

If you need to talk to us about a new or existing claim, then give us a call or simply make a claim online. Visit our claims page to make sure you have everything you need before getting in touch.

Your Insurance Account

If you’re looking to check and change your policy details or view any of your documents you can do this online with Your Insurance Account.

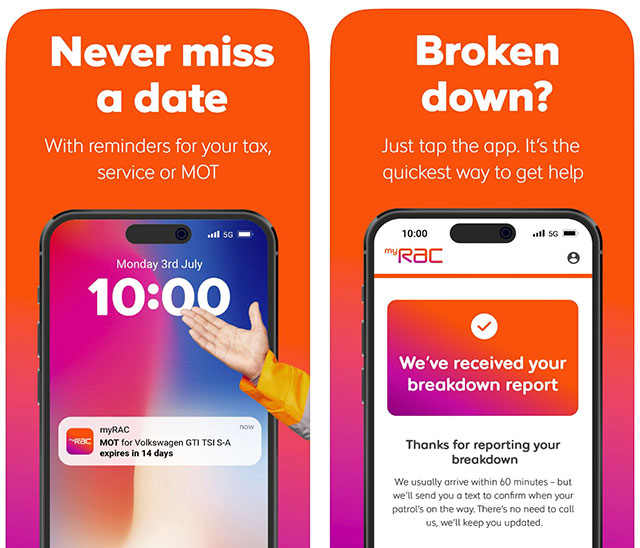

Download the myRAC app

If you’re a Tesco Car Insurance customer with Breakdown Cover, you will have access to the myRAC app provided by the RAC.

Download your policy booklet

Enter the code sent in your renewal invite pack

Error: Please enter a valid code

Enter code

Here are your documents:

Managing your policy

It’s important to let us know if there are any changes to your circumstances or details to help ensure you're covered in the event of a claim. This also applies to other named drivers on your policy.

You can make changes to your car insurance policy and update your personal details in 'Your Insurance Account'. Simply click the Sign in button and make the changes whenever you want.

We will send you details of your insurance renewal invitation approximately 21 days before your policy comes to an end. This will contain details of your renewal price, any changes to the terms and conditions and whether you need to contact us to complete your renewal.

If your policy renews automatically

If your policy renews automatically you don’t need to do anything. Your policy and any optional extras you’ve selected will continue.

Don’t forget you can opt out of automatic renewal at any time. Simply sign in to Your Insurance Account and click 'Manage Renewal', or just give us a call.

If you don’t want to renew your policy or if any of your details have changed, you’ll need to contact us before your renewal date.

If we don't hear from you we'll automatically renew your policy and take payment from the card / account details most recently provided. If you're not the card or account holder you must ensure that the card / account holder has agreed to make the renewal payment and they're aware of any changes to the amount.

If your policy does not renew automatically

If your policy doesn’t automatically renew, you can accept your renewal by simply signing in to Your Insurance Account before your renewal date. If any of your details have changed you need to contact us before your renewal date.

You can change your policy to automatically renew to ensure your cover continues. Simply sign in to 'Your Insurance Account' and click Manage renewal, or you can just give us a call.

If you haven't registered for Your Insurance Account it's quick to do, just click the 'Register' button and follow the simple steps. Make sure you have your policy number to hand.

If you don't want to renew your policy with us you don't need to contact us. Your policy will end on your renewal date and we'll send you confirmation, which will include proof of your no claims discount.

If you need to cancel your policy, please call us on 0345 246 2895*.

*This number may be included as part of any inclusive call minutes provided by your phone operator.

Breakdown Cover, Upgraded Courtesy Car Cover, Key Cover and Motor Legal Protection are available at an additional premium to add to your cover at any time - all with a guaranteed discount for Tesco Clubcard members. Full details can be found in your policy documents - copies of these can be found at the bottom of this page.

If you wish to add any of these products to your policy please call us on 0345 246 2895*.

All cover details, exclusions, excesses, monetary limits and terms are clearly laid out in our policy booklets. See our policy booklets

*This number may be included as part of any inclusive call minutes provided by your phone operator.

Important information

Our range of insurers:

Tesco Car Insurance is arranged and administered by Tesco Insurance and is underwritten by Tesco Underwriting Ltd.

Optional Extras Insurers:

- Motor Legal Protection is underwritten by AmTrust Specialty Limited

- Breakdown Cover is underwritten by RAC Insurance Ltd

- Keycover is underwritten by AA Underwriting Insurance Company Ltd. Claims are handled by Keycare

- Upgraded courtesy car is underwritten by Tesco Underwriting Ltd

You’ll find complete details of the cover, monetary limits, exclusions, excesses and terms in our policy documents.

The policy booklet and product information documents outline the benefits, limitations and exclusions that will apply to your cover.

Please make sure that you read the version applicable to your start date or renewal. You can find this date in the sections of the policy terms applicable to the cover you selected.

You can view any documents and make changes to your policy online in 'Your Insurance Account’.

If you have a Standard car insurance policy, click here for your policy booklet:

If you have Bronze, Silver or Gold policy, click here for your policy booklet:

Car Insurance Policy Booklet for Cover Plus policies:

How we use your data

Tesco Personal Finance Ltd takes the security of your data seriously. Detailed information on how we handle your data and your rights under data protection laws is available in our privacy notice.

Please see our privacy notice if you would like to know more

We collect data when you browse our website (e.g. your IP address), request a quotation, partially complete a quotation and do not purchase; or provide data indirectly via price comparison sites. We keep quote data for up to 7 years and we may use this information if you apply for a product again in the future.

We will use your data to give you quotes, provide our services to you, perform eligibility checks, work out financial and insurance risk, manage debt, protect you and us against fraud and financial crime and manage and develop our business. Automated decisions may be taken to detect crime and for credit scoring.

We use data such as your name and address, to find any Clubcard(s) that are linked to your address. That might be your Clubcard, the Clubcard of other family member(s), or the Clubcard of house or flat mates. We may use this information to tailor our communications and to try to bring you better terms, deals or offers, and this may include profiling on an on-going basis. We may also award Clubcard points.

Data may be obtained from and shared with the wider Tesco Group, credit reference agencies (CRAs) and fraud prevention agencies (FPAs). The FPAs will potentially use it to prevent fraud and money-laundering, verify your identity and establish your right to UK Residency. Depending on the outcome, this could result in the refusal of certain services, finance or employment. We will supply your personal information to CRAs and they will give us information about you on an ongoing basis.

For details of who we are and the services we provide, please read the following.

For Standard Car Insurance policies starting before 02/05/24:

For Cover+ policies:

For Bronze, Silver, Gold policies:

Our cancellation fees are changing from 02/05/24 and will apply to new policies from that date.

|

Fee type |

Policy started before 02/05/24 |

Policy started after 02/05/24 |

|---|---|---|

|

Administration fee for changes to your policy once it has started |

£25 |

£25 |

|

Cancellation fee if you cancel your policy before cover has started |

£0 |

£25 |

|

Cancellation fee if your policy is cancelled within the cooling off period |

£0 |

£25 |

|

Cancellation fee if your policy is cancelled after the cooling off period |

£40 |

£50 |

If you already have a policy with us, the new fees will apply to any renewals from 02/05/24 and your renewal invitation letter will explain these changes to you. Until then, the fees before 02/05/24 will continue to apply.

RAC Roadside Cover reduced by over 50% for all customers.

RAC Roadside Cover reduced to £15 for Clubcard customers.

Offer available to new and renewing customers.

Offer available between 1st December 2025 – 28th February 2026.

Not to be used in conjunction with any other offer.

The discount on RAC Roadside Breakdown Cover is available only when purchased at the same time as a qualifying motor insurance policy through Tesco Insurance.

Buy or renew Motor insurance with Roadside cover between 1st Dec – 28th Feb to receive discount.

Breakdown cover is provided by RAC Motoring Services.

How does my existing standard insurance relate to Bronze, Silver and Gold levels of cover?

We’ve made some changes to expand our Car Insurance products, providing more options to our customers. If you have standard car insurance it will have the same features and benefits as Silver car insurance.

Car Insurance FAQs

This will depend on factors such as your age, occupation and the type of policy cover and product you choose (NB: it is only available on Silver and Gold cover, where eligible). The cover applies on a third-party only basis if you have the vehicle owner's permission, and the vehicle is registered, insured and legal to drive in the UK, including insurance in its own right.

Please check your Certificate of Motor Insurance to confirm if you are eligible to drive another vehicle (under section 5).

Full details of any limitations are in your policy booklet.

Anyone who drives your car should be named on your policy as an additional driver. You can add a driver by signing into Your Insurance Account.

Adding additional drivers to your insurance could increase the overall cost of your policy but you will not be charged a fee when completing via this service. Your insurer reserves the right to refuse cover based on age, licence, residency and experience of the proposed additional driver.

Please see our existing FAQ 'How do I add or update my additional driver details?' for instructions on how to do.

If you want to add a temporary driver, they can be added to your policy up to a maximum of 28 days over the policy year. To do this, you will need to contact our Customer Service team and have your policy number ready. An administration fee will be applied and must be paid in addition to any change in premium.

When you apply for cover, you have the option of adding protection for your No Claims Discount (NCD) if you have a minimum of four years NCD. You must also have had no more than one fault claim in a three-year period to be eligible. Your NCD will then be maintained in the event of up to 2 claims within the first policy year.

If you renew your policy and have two claims in a three-year period, NCD protection will be removed, and if you were to have a third claim in this time, your NCD will be reduced.

Without NCD protection, claims where we are unable to make a full recovery from a third party will reduce your NCD.

NCD protection does not protect your premium and you may have to pay a higher premium and excess from your next renewal if any claims are made. Your NCD will not increase in any years in which you have a claim. If you renew your Tesco Car Insurance policy, the terms of your no claims discount protection will change. More information on how Protected NCD may be affected by multiple claims can be found in your policy booklet.

If you've driven a company car and the company have made no claims during that time, you could be eligible for a no claims discount provided that;

- the car has been used for both personal and business use with you as the main driver

- you also need to have been claim free on the company car for a minimum of one year

- you are no longer using the company car

- you will need to provide proof on company headed paper stating that you have been using the car for personal and business purposes

Contact us - we're here to help

Have a question or need help applying? Our friendly, UK-based customer service team is here to help.