Make a Pet Insurance claim

Find out how to make a claim if something happens to your cat or dog.

Find out how to make a claim if something happens to your cat or dog.

If your policy started on or after 21 January 2025, or renewed on or after 1 January 2025, the underwriter for your policy is Pinnacle Insurance plc.

To start your claim with Pinnacle, log in or register at our online Pet Portal.

Log in to your Pet Portal to start your claim with Pinnacle Insurance plc, the underwriter for your policy.

We should process your claim within a week. If you need to contact us about anything, please call us on 0344 543 1132*.

You can also contact us online or find other ways to contact us.

*This number may be included as part of any inclusive call minutes provided by your phone operator.

If your pet needs treatment, we can pay either you or the treating vet, you just need to make sure your vet accepts direct payments. All you need to do is tick a box on the claim form.

An excess is the amount you must pay if you claim on your insurance.

For customers who renewed their policy after 1 January 2025 or took out a policy on or after 21 January 2025, the excesses you pay can be found in the Tesco Pet Portal and on your Certificate of Insurance.

For customers who took out a policy before 21 January 2025 and are yet to renew, your excesses are detailed in your policy documents.

When you get a quote, you can choose to increase the excess, which will help reduce your monthly payments, but you will pay more if you need to make a claim. You are responsible for paying the excess. You must also pay the first £250 on all Third Party Liability claims.

No, claims can be made on an ongoing basis, whenever you receive a vet bill. All claims need to be made within 12 months of the treatment date.

Please note that the way you need to submit a claim may be different depending on when you took out or renewed your policy. Before you submit your claim, please make sure you are submitting it correctly.

For customers who renewed their policy after the 1st January 2025 or took out a policy on or after the 21st January 2025, your vet can now submit claims for you via Vet Pawtal. Vet Pawtal is the quickest way to submit and process claims.

We recommend you submit claims in our claim's platform, Vet Pawtal.

Click here to log in to Vet Pawtal.

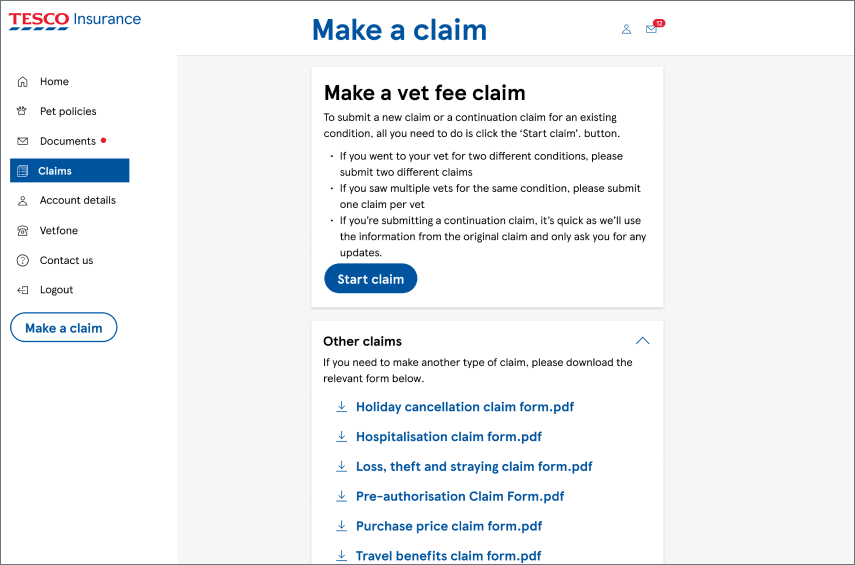

If your vet isn’t registered for Vet Pawtal, you can submit claims through the Pet Portal. Sign in, complete a claim form, and as long as we have all the details we need, we'll take it from there.

Once our assessors have reviewed your claim, it takes around 5 days to assess it; we'll let you know the outcome.

As soon as your claim’s been submitted, you'll be able to monitor its progress in the Pet Portal’s claims tracker. If you signed up, we will also keep you updated via email and text messages.

For customers who receive their documents in the post, the way we keep you updated will depend on how your claim was submitted. For claims submitted via Vet Pawtal, we will update you via email and text messages as the claims process is so quick. This won’t affect your preferences for all other communications. For Pet Portal and paper claim forms, we will keep you updated via letter.

If you don't have access to the Pet Portal, please call 0344 543 1132* and we will send you a claim form.

Calls may be recorded. *This number may be included as part of any inclusive call minutes provided by your phone operator.